The COSS Beat Goes On

Thanksgiving *Breather* Edition

We are taking a pre-thanksgiving breather in-line with the broader COSS Index which contracted sharply over the last two weeks. Couchbase traded down ~30% and Confluent traded down ~15% as every COSS name pared-back recent gains. The market continues to be on edge with inflation spiking and supply chain issues continuing to hamper trade.

In the private markets, both Netlify and Vercel raised nine-figure rounds indicating the appetite for developer-led serverless solutions. Both solutions are built on the open source technology Jamstack (Javascript, API, Markup), which was coined by the Netlify CEO Mathias Biilmann. Netlify and Vercel allows enterprises to deploy sites directly from their Github repositories and populate those sites globally across their global edge networks for lower latency and increased performance. They also use webhooks that enable dynamic backends to update content, sales, orders or virtually any other web service. Both companies integrate with AWS Lambda which provides serverless functionality that is largely extracted away from the developer experience allowing for more focus on higher-level functions.

Example: Netlify and Vercel are very interesting components of headless e-commerce solutions, where web pages are mostly static (pictures, content, prices) but load speed is critically important (56% of customers abandon websites that take more than 3 seconds to load). Storing all of this information at the edge allows for sites to ensure performance at the front end while maintaining flexibility on the backend. As shoppers load up sites in record numbers this week for Black Friday and Cyber Monday, Jamstack solutions will ensure that retailers can convert their customers more efficiently than ever before.

And one more note, GO LIONS!

Private Markets

Vercel, the San Francisco-based company that created the open-source development framework Next.js, has raised $150 million in Series D funding at a valuation of $2.5 billion. The round was led by GGV Capital.

Netlify, the serverless JAMstack platform, announced their $105M Series D led by Bessemer Venture Partners.

WSO2, building next-gen solutions for delivering APIs, applications, and digital identities, announced $90M in funding led by Goldman Sachs.

Neo4J, building the category-leading graph database, announced their $66M Series F Extension led by Inovia.

PlanetScale, building scalable, transactional databases, announced their $50M Series C led by Kleiner Perkins.

Alluxio, the in-memory file system for data orchestration, announced their $50M SeriesC led by a leading global investment firm.

Daily, working on the future of video, audio, and WebRTC, announced their $40M Series B led by Renegade Partners.

Bit, helping front-end developers collaborate on component-driven software, announced their $25M Series B led by Insight Partners.

Elementl, the company behind Dagster, announced their $15M Series A led by Index Ventures

Kubermatic, building a platform for automated Kubernetes operations, announced their $6M Seed led by Nauta Capital.

CloudQuery, building an open-source cold asset inventory platform, announced their $3.5M Seed led by BoldStartVC.

Public Markets

To track the performance of COSS companies, we’ve created an equal-weighted index comprised of public names including: Gitlab, Kaltura, Couchbase, Confluent, MongoDB, Elastic, Rapid7, Fastly and Jfrog.

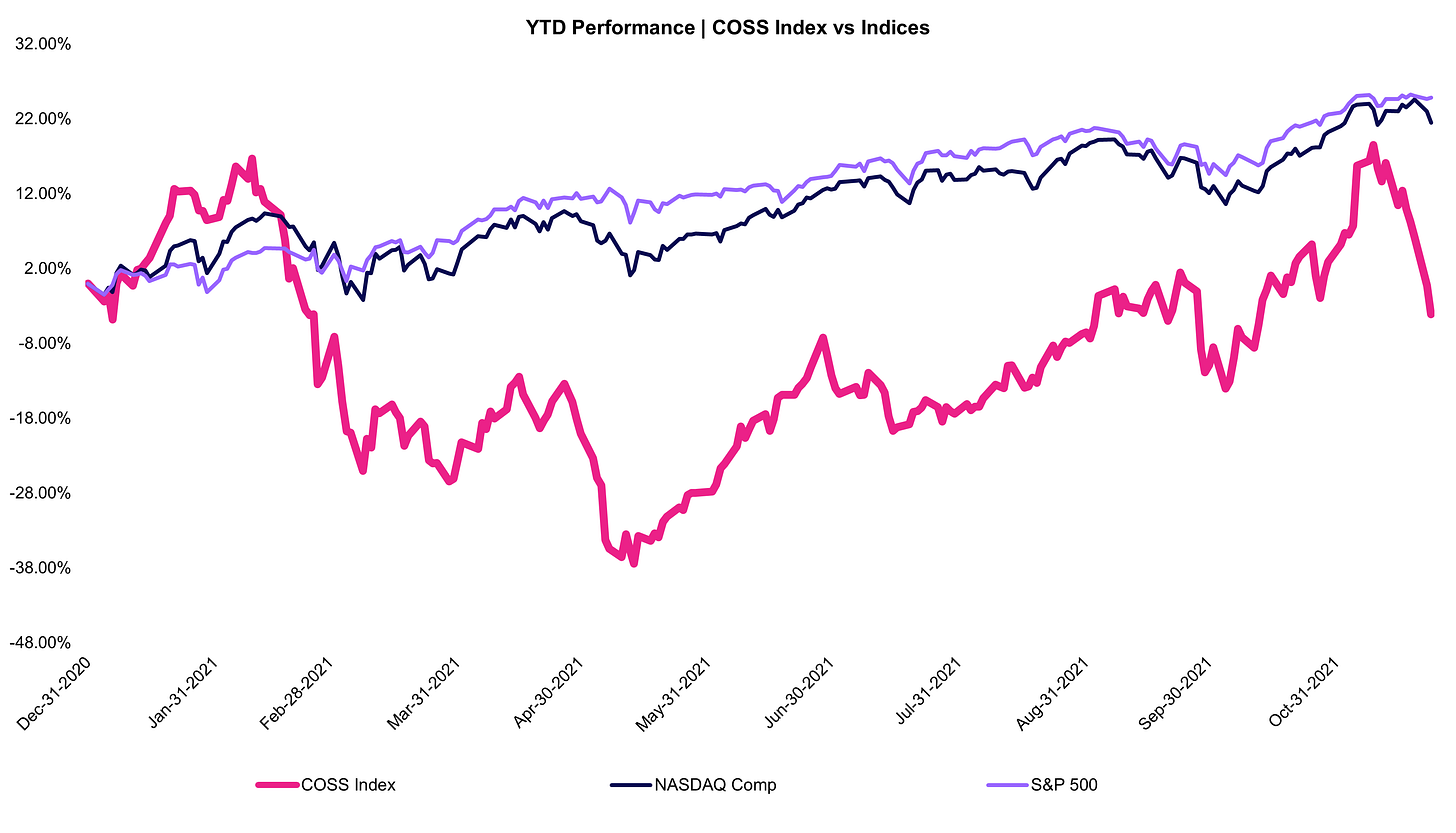

The COSS Index has been in retraced its gains over the last 3 months and fell into negative territory for the year.

COSS Index -4%

NASDAQ +22%

S&P 500 +24%

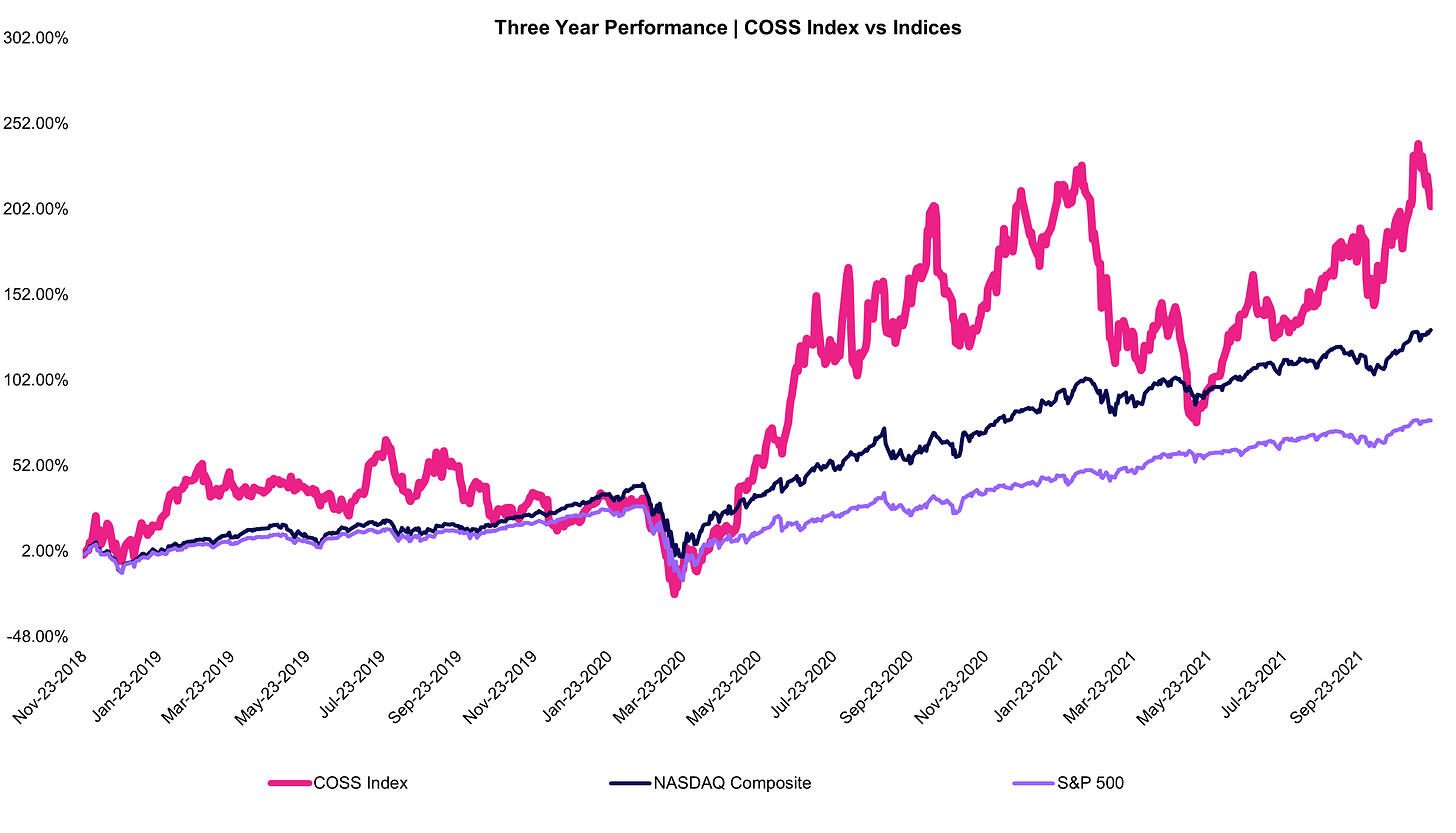

The COSS Index continued to track above the NASDAQ over the last three years but YTD gains were somewhat tempered by recent performance.

COSS Index +175%

NASDAQ +125%

S&P 500 +75%

COSS companies came back down sharply from their highest level ever losing 3 multiple turns as valuations compressed over the last two weeks. All three indices continue to trade significantly higher than their rolling five-year average.

COSS Index: Current Multiple 23.2x | Five-Year Mean: 11.8x

Emerging Cloud Index: Current Multiple 13.5x | Five-Year Mean: 10.0x

NASDAQ Composite: Current Multiple 4.5x | Five-Year Mean: 3.3x